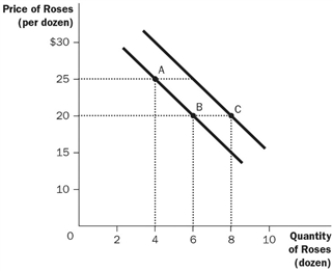

Figure 2-10

-Refer to Figure 2-10. How are the price of roses and the quantity of roses related?

Definitions:

Duration

A measure of the sensitivity of a bond's or fixed income portfolio's price to changes in interest rates, typically expressed in years.

Basis Points

A unit of measure used in finance to describe the percentage change in the value or rate of a financial instrument, equal to 1/100th of 1%.

Yield To Maturity

The total return anticipated on a bond if held until its maturity date, factoring in its current market price, face value, interest rate, and time to maturity.

Perpetuity

A type of financial instrument that offers indefinite or endless payments to the holder, often used to represent the value of fixed interest stocks.

Q23: Which of the following is an advantage

Q39: To read a quick response (QR) code

Q41: What is the best example of a

Q49: How does the invisible hand direct economic

Q76: An economic principle is that people respond

Q79: Refer to Table 3-5. What is the

Q86: Which of the following is NOT an

Q107: Which of the following would NOT be

Q190: According to economists, what do people respond

Q344: Refer to the Table 4-3. What happens