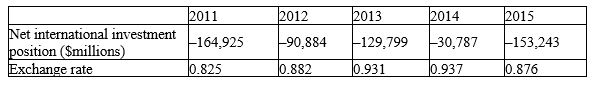

Suppose we measure Canada's net capital outflow by what Statistics Canada calls "net international investment position," and we approximate the real exchange rate of the dollar by the price of the Canadian dollar in terms of U.S. dollars. The following table gives some fictitious data on these two variables.

a. What does our open-economy macroeconomic model predict with regard to the relationship between net capital outflow and the real exchange rate?

b. Do you find evidence in the data to support the theory?

c. If you find discrepancies between the data and the theory, what could cause them?

Definitions:

Haircuts

A reduction applied to the value of assets for purposes of calculating capital requirements, risk, or losses.

Productive

The efficiency at which an individual, company, or economy can convert input resources into useful output.

Diminish Profits

The reduction in the amount of earnings as a result of increased costs, decreased revenue, or both.

Economic Profit

The financial difference created by subtracting total explicit and implicit expenses from total revenue in a company.

Q50: Illustrate the classical analysis of growth and

Q81: Which statement could be prompted by an

Q85: What will NOT change Canadian net exports?<br>A)

Q108: How does the multiplier change when the

Q133: If the quantity of loanable funds supplied

Q139: Ivan, a Russian citizen, sells several hundred

Q167: Our macroeconomic model assumes that GDP is

Q196: Which policy would someone who wants the

Q203: What is most likely to happen in

Q206: A country has $50 million of domestic