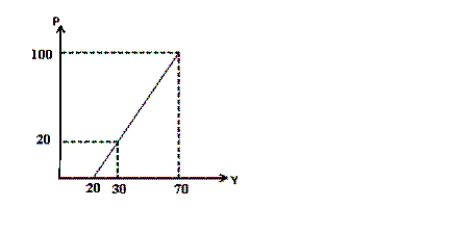

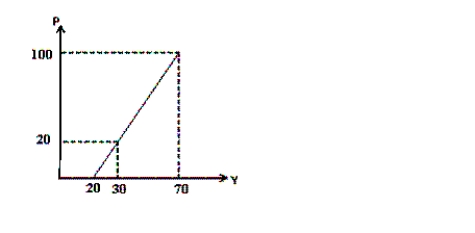

Consider the short-run aggregate-supply curve in the following graph.

a. Calculate approximately the elasticities of the curve at two price levels, P = 20 and P = 100. (Hint: The price elasticity formula is EP = percentage change in Y / percentage change in P.)

b. Explain the meaning of the elasticity in the context of the AS curve.

c. Compare the two elasticities found in (a) and discuss the results.

Definitions:

Tax Revenue

The income that is gained by governments through taxation from individuals and businesses.

Federal Government

The national government of a federation, which holds authority over the political units constituting the federation, handling matters that affect the country as a whole.

Marginal Tax Rate

The rate at which the last dollar of income is taxed, indicating the percentage of additional income that is paid in taxes.

Personal Income Tax

A tax levied on individuals or households based on their total annual income from all sources.

Q3: How does the short-run Phillips curve model

Q33: In an open economy, what does net

Q39: In an open economy, what best identifies

Q42: In the open-economy macroeconomic model, what does

Q55: What is a significant cost of inflation?<br>A)

Q102: Aggregate demand shifts to the left if

Q117: Suppose the economy is in long-run equilibrium.

Q141: Assuming the crowding-out effect but no multiplier

Q179: Which statement best predicts the effects of

Q201: According to liquidity-preference theory, if the price