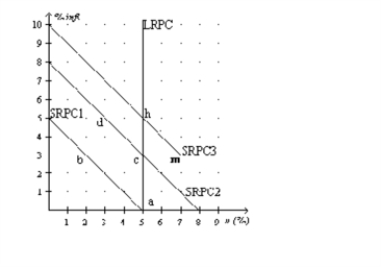

Figure 16-4

-Refer to the Figure 16-4.At point m,how do actual and expected inflation rates and unemployment rates compare?

Definitions:

Mean-Variance Efficient Portfolio

A portfolio constructed to have the highest possible return for a given level of risk, or equivalently, the lowest risk for a given level of expected return, according to Harry Markowitz's theory.

Firm-Specific Variances

Variability in a firm's stock price or returns that is attributable to factors unique to that firm, as opposed to general market factors.

Macroeconomic Factor

A wide-scale economic condition or variable that influences a broad economy and consequently affects individual businesses and financial markets.

Evolution of Beta

The evolution of beta refers to changes in the beta coefficient of an asset or portfolio over time, indicating variations in its volatility in relation to the broader market.

Q10: What does fiscal policy primarily affect in

Q15: It is possible that the cost of

Q35: Article I, Section 1 of the U.S.

Q37: Explain the time inconsistency of monetary policy.

Q44: Suppose that changes in aggregate demand tended

Q48: An increase in the money supply shifts

Q86: An economy is described by the aggregate-demand

Q92: An adverse supply shock shifts the short-run

Q142: Refer to the Figure 16-2. Suppose the

Q208: What happens to prices and output when