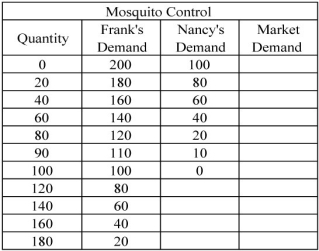

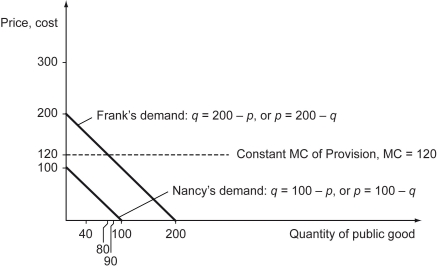

Scenario: Frank and Nancy live in a small community on Cape Cod in Massachusetts. For simplicity, assume Frank and Nancy are the only individuals in the community. Each has a demand for mosquito control, given by the following table, equations, and figure. Assume that mosquito control is a public good. Mosquito control is provided at a constant marginal cost of $120.

Frank's demand: qFᵣₐnk = 200 - p,

Frank's inverse demand = (Marginal Private Benefit) : p = 200 - q,

Nancy's demand: qNₐncᵧ = 100 - p,

Nancy's inverse demand = (Marginal Private Benefit) : p = 100 - q,

-Refer to the scenario above.In the private market equilibrium,what are the quantities demanded of mosquito control for Frank and Nancy? Explain your answer.

Definitions:

Marginal Tax Rate

The tax rate paid on an additional dollar of income.

Taxable Personal Income

The portion of an individual's earnings that is subject to taxation, after accounting for deductions and exemptions.

Proprietary Income

Income generated from owning a business or holding exclusive rights to a product or service.

Government-Run Businesses

Enterprises or organizations that are owned and operated by the government rather than by private individuals or other businesses.

Q8: Refer to the figure above.The producer surplus

Q31: Which of the following statements is true?<br>A)

Q53: Which of the following is likely to

Q64: A minimum wage policy is an example

Q115: A production possibilities curve is plotted for

Q125: Deadweight loss refers to the loss in

Q144: Refer to the table above.If the market

Q153: The market price of physical capital is

Q176: Refer to the table above.If the world

Q195: A budget surplus occurs when _.<br>A) government