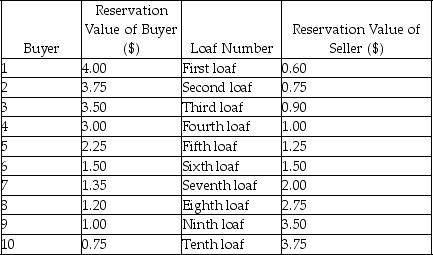

Scenario: The table below shows the reservation values of ten buyers and a seller for a loaf of bread. Each buyer would buy at most one loaf and the seller can make up to ten loaves. Initially trades happen under the market mechanism with each agent making a decision according to the market price and his or her own reservation value. Then the government imposes a price ceiling of $1.00 per unit.

-Refer to the scenario above.Suppose that,after the price ceiling is imposed,the seller uses a lower quality flour that reduces his marginal cost by $0.50 for each loaf.Buyers suspect that the quality may be lower,and their reservation value falls by $0.25.At the legal price,there will be ________.

Definitions:

Block Transactions

Large-scale securities trades on stock markets, usually involving at least 10,000 shares or bonds.

NYSE

The New York Stock Exchange, one of the world's largest stock exchanges by market capitalization, located in New York City.

Stop-buy Order

A trading instruction used to purchase a security when it reaches a price above its current market price, typically to limit a loss on a short sale.

Short Sellers

Investors who borrow shares of a stock they expect to decrease in value, sell them, and then plan to buy them back at a lower price to return to the lender, profiting from the decline.

Q41: Refer to the scenario above.If the marginal

Q44: Four friends decide to have a party

Q92: Refer to the figure above.The income effect

Q125: Deadweight loss refers to the loss in

Q133: Refer to the figure above.What is the

Q153: The market price of physical capital is

Q173: The local community in a town has

Q209: Refer to the above scenario.This $2 price

Q221: When the production of a good generates

Q235: Which of the following statements is true?<br>A)