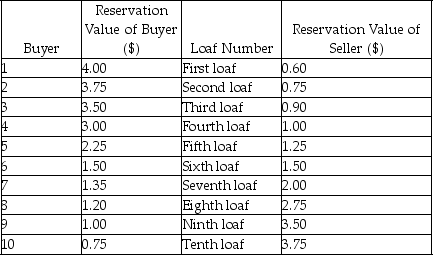

Scenario: The table below shows the reservation values of ten buyers and a seller for a loaf of bread. Each buyer would buy at most one loaf and the seller can make up to ten loaves.

-Refer to the scenario above.Suppose that the government forces the seller to sell 10 loaves,each at its marginal cost,to the government.Then the government sells the 10 loaves to buyers,one for each buyer,at their reservation values.What is the social surplus? What is the difference between the largest and the smallest among buyers' surpluses?

Definitions:

Deferred Income Taxes

Tax liabilities that arise due to timing differences between the recognition of income and expenses in the financial statements and their recognition in the tax returns, deferred to future periods.

Life Insurance Proceeds

The amount of money paid out to the beneficiary of a life insurance policy upon the death of the insured or at the policy's maturity.

Deferred Tax Liability

An accounting term representing a tax obligation that a company owes but is allowed to pay at a future date.

Pretax Accounting Income

Income earned by a business before taxation has been deducted, as recorded in its financial accounts.

Q15: Without any change in the demand for

Q16: Refer to the scenario above.The social optimum

Q28: When a firm hires 10 units of

Q45: Your roommate claims we can understand the

Q74: Refer to the scenario above.How many chairs

Q90: Social Security taxes in the U.S.tend to

Q122: Refer to the scenario above.If the hourly

Q131: Refer to the figure above.What is the

Q150: Refer to the above scenario.Your marginal tax

Q242: Refer to the scenario above.What is the