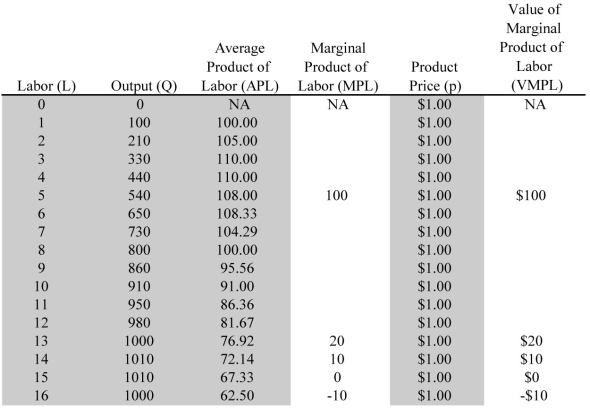

Scenario: A small apple orchard operates in a perfectly competitive output market (the market for apples) and input or factor market (the market for apple pickers) . The market price of apples is $1 per pound, and the market wage for apple pickers is $50 per day. See the following table.

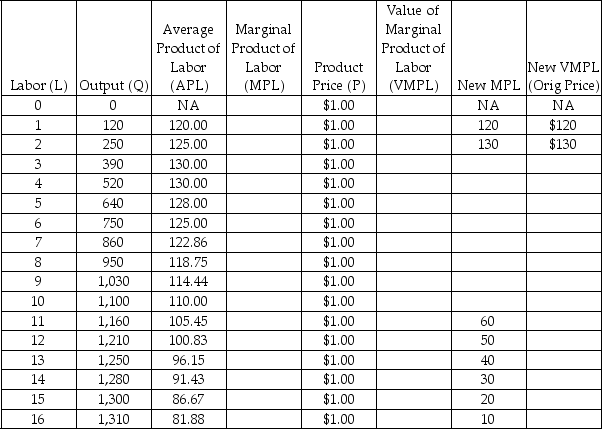

-Refer to the scenario above.Now suppose that new apple-picking baskets increase the productivity of apple pickers,as noted in the following table.The new profit-maximizing number of workers to hire is ________.

Definitions:

New Products

Items that have been recently introduced to the market, offering innovative solutions or improvements over existing products.

Interest-Rate Cost-Of-Funds

Represents the interest rate that banks or other financial institutions pay for the funds that they use in their operations, including deposits and loans from other institutions.

Perfectly Elastic

A term used in economics to describe a situation where the quantity demanded or supplied changes infinitely in response to any change in price.

Expected Rates

Anticipated figures or percentages, often pertaining to finance, such as interest rates or returns on investment.

Q27: Suppose a tax is imposed on the

Q42: A price ceiling leads to a(n)_ if

Q43: Under fair-returns price regulation,_.<br>A) deadweight loss is

Q109: Refer to the figure above.How many units

Q113: The profit-maximizing rule for a competitive firm

Q121: Refer to the scenario above.If each homeowners

Q147: Refer to the scenario above.The socially optimal

Q151: Refer to the figure above.What is the

Q164: A retired athlete built a gym near

Q204: A firm will continue to purchase and