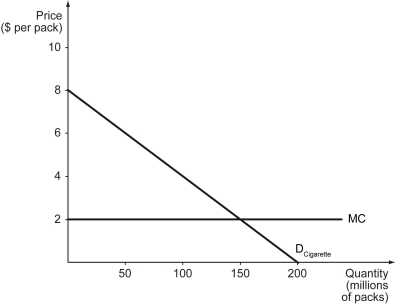

Scenario: Tobac Co. is a monopolist in the cigarette market in Nicotiana Republic, where the U.S. dollar is used as the official currency. The firm faces the demand curve shown below. The firm has a constant marginal cost of $2.00 per pack. The fixed cost of the firm is $50 million. To answer the questions below, it is useful to know that the equation of the (inverse) demand curve is P = 8 - 0.04Q, where Q is the quantity demanded (in millions of packs) and P is the price per pack (in $) . Also, you should draw in the marginal revenue curve.

-Refer to the scenario above.If the quantity sold is 50 million packs,then the firm's total revenue is ________ and the total cost is ________.

Definitions:

Expected Present Value

Expected present value is a financial concept that calculates the current worth of a future sum of money or stream of cash flows given a specified rate of return.

Professional Contract

A legal agreement between a professional and an entity that outlines terms of employment or service provision.

Injury

Physical harm or damage to the body caused by external force, which may result from accidents, falls, hits, weapons, and other causes.

Marginal Utility

The change in total utility generated by consuming one additional unit of a good or service.

Q28: An oligopoly model in which sellers compete

Q55: Refer to the figure above.Under monopoly,producer surplus

Q73: Refer to the figure above.What is the

Q80: Efficient government intervention requires that _.<br>A) the

Q117: Refer to the scenario above.Each firm will

Q129: A profit-maximizing monopolist produces the quantity at

Q154: Suppose a monopolistic competitor produces 2,000 units

Q165: The value of the marginal product of

Q218: Why are private enterprises more efficient than

Q248: For a firm with market power,the price