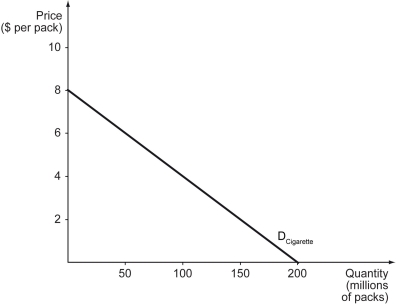

Scenario: Tobac Co. is a monopolist in the cigarette market in Nicotiana Republic, where the U.S. dollar is used as the official currency. The firm faces the demand curve shown below. The firm has a constant marginal cost of $2.00 per pack. The fixed cost of the firm is $50 million. To answer the questions below, it is useful to know that the equation of the (inverse) demand curve is P = 8 - 0.04Q, where Q is the quantity demanded (in millions of packs) and P is the price per pack (in $) . Also, you should draw in the marginal revenue curve.

-Refer to the scenario above.What is Tobac Co.'s total revenue when it sells 50 million packs of cigarettes?

Definitions:

Bond Agreement

A legal contract between the bond issuer and the bondholders, outlining the terms of the bond such as the interest rate, maturity date, and obligations of the issuer.

Treasury Securities

Government-issued debt instruments used to finance government spending as an alternative to taxation.

Maturity Risk

The risk that arises from the length of time until the principal amount of a fixed-income investment becomes due and payable, affecting the investment's exposure to interest rate changes.

Base Interest Rate

The minimum interest rate set by a central bank for lending to other banks, used as a benchmark for interest rates on loans and mortgages.

Q32: Suppose a firm sells its product in

Q35: The example of decoding the human genome

Q70: Meryl works 10 hours a day in

Q102: Which of the following correctly identifies the

Q152: Refer to the scenario above.Does Stephanie have

Q163: Which of the following is likely to

Q165: The value of the marginal product of

Q185: Land is _.<br>A) an artificially created input

Q218: Why are private enterprises more efficient than

Q224: Refer to the scenario above.Now suppose that