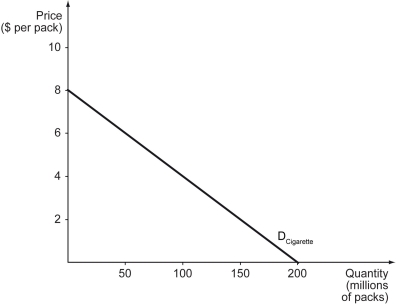

Scenario: Tobac Co. is a monopolist in the cigarette market in Nicotiana Republic, where the U.S. dollar is used as the official currency. The firm faces the demand curve shown below. The firm has a constant marginal cost of $2.00 per pack. The fixed cost of the firm is $50 million. To answer the questions below, it is useful to know that the equation of the (inverse) demand curve is P = 8 - 0.04Q, where Q is the quantity demanded (in millions of packs) and P is the price per pack (in $) . Also, you should draw in the marginal revenue curve.

-Refer to the scenario above.Tobac Co.'s total revenue is maximized when it sells ________ packs of cigarettes at ________ per pack.

Definitions:

Accounts Receivable Turnover

A financial ratio indicating how many times a company's receivables are turned over during a specific period, often used to assess the effectiveness of credit and collection policies.

Net Sales

The revenue from the sale of goods or services after deducting returns, allowances, and discounts.

Accounts Receivable Turnover

A financial metric that measures how often a company collects its average accounts receivable balance within a period.

Accounts Receivable Turnover

A financial metric that measures how efficiently a company collects on its receivables or the speed of their credit sale conversions into cash.

Q30: Refer to the figure above.On what interval

Q48: The cost of producing each bottle of

Q62: A monopolist faces a linear,downward-sloping demand curve.If

Q68: Refer to the scenario above.Jack will derive

Q141: Which of the following statements is true?<br>A)

Q145: Which of the following is an example

Q174: A monopolistic competitor produces 100 units of

Q207: Which of the following is likely to

Q230: A _ is a plan by one

Q250: When the price of the same product