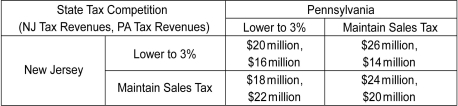

Scenario: Contiguous states often use tax policy to attract residents, firms, and economic activity. These "tax competitions" between states can be modeled with game theory. Suppose New Jersey currently has a state sales tax of 7 percent and Pennsylvania has a state sales tax of 6 percent. The game shown below models the effect of a reduction in each state's sales tax rate to 3 percent on each state's sales tax revenue. Assume the motivation of each state is to maximize tax revenue. The first number in a cell is the payoff to New Jersey; the second number is the payoff to Pennsylvania.

(Source: John Greenwald, "A No-Win War Between the States," Time, April 8, 1996, 44-45.

-Refer to the scenario above.Does Pennsylvania have a dominant strategy?

Definitions:

Conditional Sales Contract

An agreement for the purchase of goods that does not fully transfer ownership to the buyer until certain conditions, typically full payment, have been met.

Simple Interest

Interest calculated only on the principal amount, or the initial sum of money borrowed or invested, without compounding.

Finance Company

A business that provides loans to individuals and companies, unlike banks, primary lending revolves around installment credit and financing consumer purchases.

Assignable Loan Contract

A loan agreement that allows the lender to transfer the loan to another party.

Q36: As the income of an individual increases,she

Q68: The pie chart below shows the market

Q92: Refer to the figure above.The output produced

Q96: Which of the following is true?<br>A) A

Q120: All of the following are research studies

Q155: Advances in computing power are an example

Q163: Why does the economy of scale lead

Q184: Refer to the scenario above.According to the

Q204: A firm will continue to purchase and

Q212: In an oligopoly industry with differentiated products,price