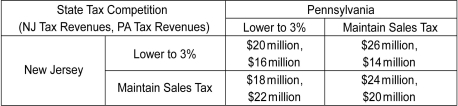

Scenario: Contiguous states often use tax policy to attract residents, firms, and economic activity. These "tax competitions" between states can be modeled with game theory. Suppose New Jersey currently has a state sales tax of 7 percent and Pennsylvania has a state sales tax of 6 percent. The game shown below models the effect of a reduction in each state's sales tax rate to 3 percent on each state's sales tax revenue. Assume the motivation of each state is to maximize tax revenue. The first number in a cell is the payoff to New Jersey; the second number is the payoff to Pennsylvania.

(Source: John Greenwald, "A No-Win War Between the States," Time, April 8, 1996, 44-45.

-Refer to the scenario above.Is there a dominant strategy equilibrium?

Definitions:

Vision

The ability to see, which involves the process of light being interpreted by the brain as visual images.

Taste

A sensory experience primarily associated with the tongue, allowing for the perception of sweetness, saltiness, sourness, bitterness, and umami.

Expressive Aphasia

A neurological condition resulting from damage to the areas of the brain responsible for language production, characterized by difficulty in expressing oneself verbally or in writing.

Traumatic Brain Injury

An injury to the brain resulting from an external mechanical force, potentially causing temporary or permanent impairment of cognitive, physical, and psychosocial functions.

Q39: A firm with market power _.<br>A) faces

Q41: All firms in a monopolistically competitive industry

Q42: Refer to the scenario above.When Tobac Co.'s

Q54: Refer to the figure above.What is the

Q150: Refer to the scenario above.Suppose Firm 1

Q178: If a firm pays married women less

Q184: An industry composed of two identical firms

Q207: Which of the following is likely to

Q216: Refer to the figure above.What is the

Q276: A monopolist faces an average total cost