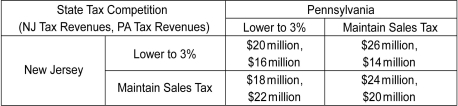

Scenario: Contiguous states often use tax policy to attract residents, firms, and economic activity. These "tax competitions" between states can be modeled with game theory. Suppose New Jersey currently has a state sales tax of 7 percent and Pennsylvania has a state sales tax of 6 percent. The game shown below models the effect of a reduction in each state's sales tax rate to 3 percent on each state's sales tax revenue. Assume the motivation of each state is to maximize tax revenue. The first number in a cell is the payoff to New Jersey; the second number is the payoff to Pennsylvania.

(Source: John Greenwald, "A No-Win War Between the States," Time, April 8, 1996, 44-45.

-Refer to the scenario above.Is there a set of payoffs that is superior to the payoffs realized at the dominant strategy equilibrium?

Definitions:

Adjusting Journal Entries

Entries made in the accounting records to correct any discrepancies or to make non-cash adjustments.

Wages Expense

The total cost incurred by an employer for paying the hourly earnings of its employees.

Wages Payable

The total amount of wages earned by employees that the company has not yet paid.

End-Of-Period Spreadsheet

An End-Of-Period Spreadsheet is a document used in accounting to compile balances from journals and ledgers, facilitating adjustments and preparing financial statements.

Q21: Is there any similarity between a perfectly

Q90: Refer to the scenario above.If Aqua Inc.charges

Q133: Refer to the table above.What is the

Q137: Refer to the scenario above.If the game

Q176: Which of the following is likely to

Q180: _ is a market structure with only

Q183: Refer to the scenario above.Which of the

Q229: Refer to the figure above.The consumer surplus

Q238: Refer to the figure above.If the government

Q257: If a new seller enters a market