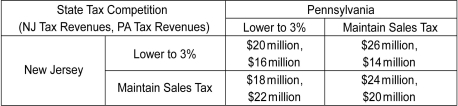

Scenario: Contiguous states often use tax policy to attract residents, firms, and economic activity. These "tax competitions" between states can be modeled with game theory. Suppose New Jersey currently has a state sales tax of 7 percent and Pennsylvania has a state sales tax of 6 percent. The game shown below models the effect of a reduction in each state's sales tax rate to 3 percent on each state's sales tax revenue. Assume the motivation of each state is to maximize tax revenue. The first number in a cell is the payoff to New Jersey; the second number is the payoff to Pennsylvania.

(Source: John Greenwald, "A No-Win War Between the States," Time, April 8, 1996, 44-45.

-Refer to the scenario above.Does New Jersey have a dominant strategy?

Definitions:

Gross Annual Income

Gross Annual Income refers to the total amount of income earned in a year before any deductions are made, such as taxes and retirement contributions.

Down Payment

An initial payment made when something is bought on credit, often expressed as a percentage of the total purchase price.

Buy Down

A financing technique where points are paid upfront by a borrower to reduce the interest rate on a loan.

Point Purchased

In finance, particularly in mortgage contexts, this refers to prepaid interest that the borrower opts to pay upfront in order to lower the interest rate on the loan.

Q35: The U.S.book publishing industry is an example

Q52: Which of the following is likely to

Q72: Among the following,which is the best example

Q78: If a monopolist decides to charge a

Q104: La Dila and Swiss Pro are the

Q138: Refer to the scenario above.What will be

Q168: Which of the following correctly identifies a

Q181: Refer to the scenario above.Tom will receive

Q188: Which of the following market structures provides

Q218: A night shift cashier getting paid more