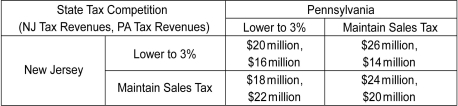

Scenario: Contiguous states often use tax policy to attract residents, firms, and economic activity. These "tax competitions" between states can be modeled with game theory. Suppose New Jersey currently has a state sales tax of 7 percent and Pennsylvania has a state sales tax of 6 percent. The game shown below models the effect of a reduction in each state's sales tax rate to 3 percent on each state's sales tax revenue. Assume the motivation of each state is to maximize tax revenue. The first number in a cell is the payoff to New Jersey; the second number is the payoff to Pennsylvania.

(Source: John Greenwald, "A No-Win War Between the States," Time, April 8, 1996, 44-45.

-Refer to the scenario above.Is there a dominant strategy equilibrium?

Definitions:

Tightness

In cultural psychology, the degree to which a culture restricts or regulates behaviors, with strict norms and intolerance for deviation.

Affective Forecasting

The process by which individuals predict their future emotional states or reactions to events.

Positive Events

Occurrences or experiences that contribute to one's happiness, well-being, or positive emotional state.

Negative Events

Unfortunate or harmful incidents that can lead to emotional distress, physical harm, or psychological impact on individuals.

Q70: Refer to the scenario above.The interest earned

Q76: Refer to the scenario above.Suppose Firm 1

Q80: Refer to the scenario above.Which of the

Q98: The outcome of first-degree price discrimination is

Q116: Markets in which the Herfindahl-Hirschman Index _

Q135: Which of the following is true?<br>A) Firms

Q206: Which of the following is likely to

Q221: Compared to a firm under perfect competition,a

Q227: Refer to the scenario above.The increase in

Q247: Refer to the figure above.Compared to the