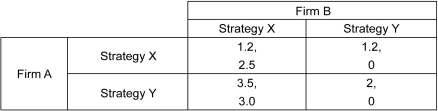

Scenario: The payoff matrix given below shows the payoffs to two rival firms in millions of U.S. dollars for each strategy they choose. The first number listed in each cell is the payoff to the row player, and the second number listed is the payoff to the column player.

-Refer to the scenario above.In the dominant strategy equilibrium,the payoff to Firm B is ________.

Definitions:

Non-Controlling Interests

A minority stake in a company, representing shareholders who do not have controlling interest or decision-making power in the enterprise.

Goodwill

Goodwill represents the excess of the purchase price paid for an acquired company over the fair value of its identifiable net assets at the time of acquisition.

Equity Method

An accounting technique used to record investments in which the investor has significant influence over the investee, recognizing their share of the profits and losses.

Indefinite Useful Life

An intangible asset with an expected life that extends beyond the foreseeable future, not requiring amortization but subject to annual impairment tests.

Q6: The Herfindahl-Hirschman Index is used to _.<br>A)

Q14: The following table shows the demand and

Q21: The _ is referred to as future

Q109: Refer to the scenario above.Which of the

Q109: Refer to the scenario above.This is an

Q118: Refer to the figure above.What does the

Q163: Which of the following is true of

Q171: The market for high-end cars is likely

Q194: The automobile industry in Petrovia has a

Q286: A fundamental feature of a monopolistic market