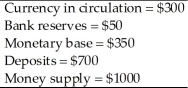

Consider an economy that has the following monetary data.

The monetary base and the money supply are expected to grow at a constant rate of 20% per year.Inflation and expected inflation are 20% per year.Suppose that bank reserves and currency pay no interest,all currency is held by the public,and bank deposits pay no interest.

(a)What is the cost to the public of the inflation tax?

(b)What is the nominal value of seignorage over the year?

(c)What is the profit to the banks from the inflation?

Definitions:

Contractual Obligation

is a legal duty that arises out of a contract, requiring a party to fulfill the terms of the agreement.

Drawer

Drawer is the party in a bill of exchange, such as a check, who is making the payment, directing the drawee (usually a bank) to pay a specified sum to the payee.

Indorser

A person who signs a negotiable instrument, such as a check or promissory note, on the back, indicating their consent to transfer the document’s ownership or to guarantee its payment.

Negotiable Instrument

A written and signed document promising a specified amount of money to a specified person or bearer on demand or at a future date.

Q10: The claim that lower environmental standards in

Q13: Monopoly powers given to domestic utility companies

Q15: Because the natural rate of unemployment is

Q18: The current account balance of the United

Q29: The largest liability of the Fed from

Q35: What is Joseph Stiglitz' main criticism regarding

Q41: In an open economy,a shift down and

Q49: Which of the following would be associated

Q73: You are given the following budget data

Q94: Some economists argue that Okun's Law overstates