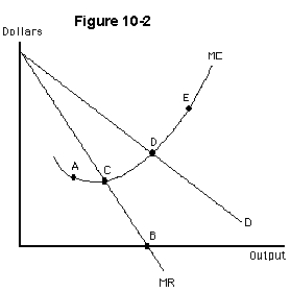

-For the monopolist in Figure 10-2 producing at point D,which of the following statements is true?

Definitions:

Self-Employment Tax

Self-employment tax is a tax consisting of Social Security and Medicare taxes primarily for individuals who work for themselves, comparable to the payroll tax paid by employers and employees.

Consulting Income

Earnings derived from providing expert advice to individuals or organizations in a specific field.

Local Business

A company that provides goods or services to a local population. It's often characterized by having a physical presence in a community.

Net Income

The total profit of a company after all expenses, taxes, and costs have been deducted from total revenues.

Q53: A Pareto improvement is any action that

Q58: A pizza shop owner needs to buy

Q60: In a long-run perfectly competitive equilibrium,<br>A)marginal cost

Q61: Consider the firm shown in Figure 8-6.If

Q66: Involuntary exchanges,such as robbery,<br>A)represent potential Pareto improvements<br>B)are

Q83: Which of the following is not a

Q85: In a perfectly competitive labor market,no individual

Q109: The efficient markets theory of stock prices,implies

Q159: When a non-discriminating monopolist is maximizing profit,then<br>A)its

Q171: In Figure 10-28,the monopolist's profit-maximizing output level