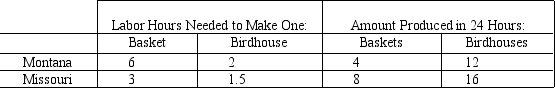

Table 3-3

-Refer to Table 3-3.Montana has a comparative advantage in

Definitions:

Equity Securities

Financial instruments representing ownership interest in a company, such as stocks.

Debt Securities

Financial instruments representing a loan made by an investor to a borrower, typically involving periodic interest payments and the return of principal at maturity.

Held-to-maturity Securities

These are financial assets that a company has the intent and ability to hold until they mature.

Amortized Cost

The expense of an intangible asset over its useful life.

Q37: Explain the difference between absolute advantage and

Q57: Refer to Table 3-5.The opportunity cost of

Q67: In the early 1980s,U.S.economic policy was directed

Q78: A likely example of substitute goods for

Q84: Refer to Table 3-6.If England and Spain

Q85: Which of the following would not affect

Q86: If the average cost of transporting a

Q196: Fill in the accompanying table,showing whether equilibrium

Q233: When the law of demand applies to

Q265: You lose your job and as a