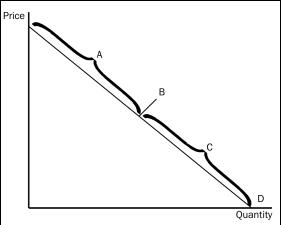

Figure 5-1

-Refer to Figure 5-1.Assume the section of the demand curve labeled A corresponds to prices between $6 and $12.Then,when the price increases from $8 to $10,

Definitions:

Excise Taxes

Taxes levied on specific goods, such as tobacco or alcohol, often to discourage their use or to raise revenue.

Taxation

The practice by which governments impose charges on citizens and corporate entities to fund public spending and services, playing a key role in economic policy and regulation.

Local Government

The administration of a particular town, city, county, or district with responsibility for providing services and enforcing regulations at a local level.

Expenditures

The action of spending funds or the amount spent on various items or services, including operational costs, investments, and personal spending.

Q35: New oak tables are normal goods.What would

Q56: The incidence of a tax depends on

Q63: A payroll tax is a<br>A)fixed number of

Q74: For a country producing two goods,the opportunity

Q106: How does total revenue change as one

Q126: Which of the following events could cause

Q143: A linear,upward-sloping supply curve has<br>A)a constant slope

Q148: Refer to Figure 6-13 The amount of

Q209: The supply of a good will be

Q255: Another term for equilibrium price is<br>A)dynamic price.<br>B)market-clearing