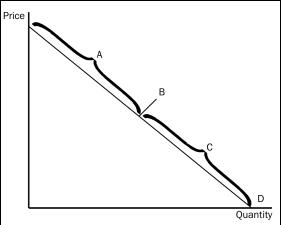

Figure 5-1

-Refer to Figure 5-1.The section of the demand curve labeled A represents the

Definitions:

Average Tax Rate

Average Tax Rate is the proportion of the total income paid as taxes, calculated by dividing the total taxes by the total taxable income.

Total Taxes

The combined amount of all the taxes imposed by a government on an individual or business, including income tax, property tax, sales tax, etc.

Average Tax Rate

The proportion of total income that is paid in taxes, calculated by dividing the total tax paid by the total income.

Total Income

The sum of all earnings obtained by an individual, household, or firm, including wages, salaries, profits, rents, and other forms of revenue.

Q2: Buyers of a good bear the larger

Q3: If sellers do not adjust their quantities

Q18: The main reason for using the midpoint

Q66: When the price of a good is

Q77: Economists compute the price elasticity of demand

Q91: A reduction in an input price will

Q139: Cross-price elasticity is used to determine whether

Q168: Refer to Figure 4-9.If the price is

Q184: Which of the following statements about comparative

Q219: Refer to Table 4-1.If the price increases