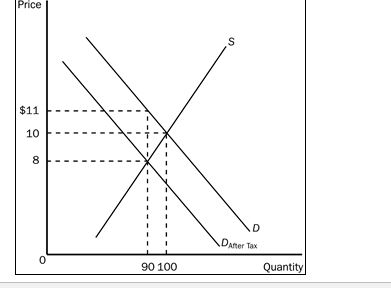

Using the graph shown,answer the following questions.

a.What was the equilibrium price in this market before the tax?

b.What is the amount of the tax?

c.How much of the tax will the buyers pay?

d.How much of the tax will the sellers pay?

e.How much will the buyer pay for the product after the tax is imposed?

f.How much will the seller receive after the tax is imposed?

g.As a result of the tax, what has happened to the level of market activity?

Definitions:

Aortic Bodies

Small clusters of chemoreceptive cells located near the arch of the aorta that detect changes in the blood's oxygen, carbon dioxide, and pH levels.

Carotid Bodies

Small, complex structures located at the bifurcation of carotid arteries, playing a crucial role in monitoring the oxygen levels in blood.

Simple Squamous Epithelium

A single layer of flat, scale-like cells that line organs and body cavities, allowing for easy diffusion or filtration due to their thinness.

Q13: The initial impact of a tax on

Q39: If a price ceiling is not binding,it

Q45: Using the midpoint method,the price elasticity of

Q55: Refer to Table 7-1.If the table represents

Q74: Refer to Figure 6-6.Which of the following

Q97: The value of the price elasticity of

Q131: One disadvantage of government subsidies over price

Q198: Generally,a firm is more willing and able

Q216: Refer to Figure 6-10.Sellers effectively pay how

Q239: The price elasticity of supply measures how