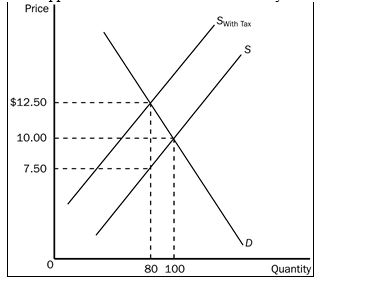

Using the graph shown,answer the following questions.

a.What was the equilibrium price and quantity in this market before the tax?

b.What is the amount of the tax?

c.How much of the tax will the buyers pay?

d.How much of the tax will the sellers pay?

e.How much will the buyer pay for the product after the tax is imposed?

f.How much will the seller receive after the tax is imposed?

g.As a result of the tax, what has happened to the level of market activity?

Definitions:

Break-even Sales

The amount of revenue needed to cover total costs, both fixed and variable, at which point a business neither makes a profit nor incurs a loss.

Wholesale Division

A segment of a company that deals with selling goods in large quantities at lower prices typically to retailers, rather than selling them directly to consumers.

Fixed Expenses

Expenses, like rent, wages, and insurance fees, that stay the same no matter how much is produced or sold.

Break-even Sales

The amount of revenue needed to cover total fixed and variable costs, resulting in zero profit or loss.

Q3: Jeff decides that he would pay as

Q92: Nobel Prize-winning economist Milton Friedman said that,"In

Q111: Price ceilings and price floors that are

Q113: Economists disagree on whether labor taxes cause

Q124: Refer to Figure 7-1.When the price is

Q144: In recent decades,which of the following U.S.presidents

Q164: Which of the following expressions represents a

Q188: Refer to Figure 8-2.The price that sellers

Q211: Refer to Figure 7-10.The efficient price-quantity combination

Q258: The local pizza restaurant makes such great