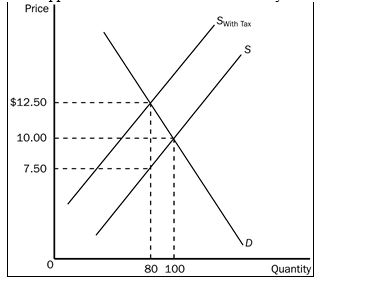

Using the graph shown,answer the following questions.

a.What was the equilibrium price and quantity in this market before the tax?

b.What is the amount of the tax?

c.How much of the tax will the buyers pay?

d.How much of the tax will the sellers pay?

e.How much will the buyer pay for the product after the tax is imposed?

f.How much will the seller receive after the tax is imposed?

g.As a result of the tax, what has happened to the level of market activity?

Definitions:

Strategic Management

The process of formulating, implementing, and evaluating cross-functional decisions that enable an organization to achieve its objectives.

Value Statement

A declaration that outlines an organization's core beliefs and principles, guiding its behavior and decision-making.

Confidence

The belief in one's abilities or qualities, often leading to a sense of self-assurance in their actions or decisions.

Differentiation Strategy

A business approach focusing on developing unique products or services to stand out from competitors and attract a specific market segment.

Q58: The Social Security tax is a tax

Q68: Suppose that a tax is placed on

Q96: When a tax is imposed on tea

Q99: Refer to Scenario 8-1.Assume Ryan is required

Q154: Refer to Table 5-2.Which of the three

Q160: Which of the following observations would be

Q214: Refer to Figure 7-11.At the equilibrium,consumer surplus

Q223: Refer to Figure 6-14.Before the tax is

Q228: Refer to Figure 6-10.From this tax the

Q231: When a country is on the downward-sloping