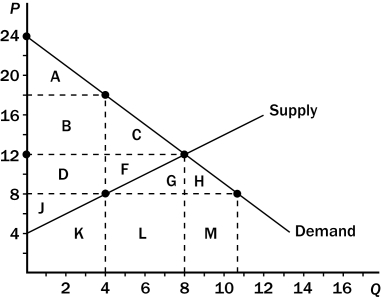

Figure 8-7 The graph below represents a $10 per unit tax on a good. On the graph, Q represents quantity and P represents price.

-Refer to Figure 8-7.After the tax goes into effect,consumer surplus is the area

Definitions:

Current Tax Liabilities

Taxes owed to the government within the current fiscal year.

Temporary Difference

Refers to the differences that arise between the tax base of an asset or liability and its carrying amount in the financial statements, which will result in taxable or deductible amounts in future years.

Interest On Municipal Bonds

The periodic payments made to investors of municipal bonds, often exempt from federal and sometimes state and local taxes.

MACRS Depreciation

Modified Accelerated Cost Recovery System, a method of depreciation for tax purposes in the United States that allows a faster write-off of assets.

Q2: Refer to Figure 8-7.The tax causes consumer

Q19: Using the graph shown,answer the following questions.<br>a.What

Q50: Suppose the demand curve for a good

Q58: Refer to Table 7-5.The equilibrium or market-clearing

Q108: If a tax is imposed on a

Q153: Economists agree that trade ought to be

Q156: Answer the following questions based on the

Q185: Refer to Figure 9-6.Which of the following

Q203: Suppose that Australia imposes a tariff on

Q259: Negative externalities occur when one person's actions<br>A)cause