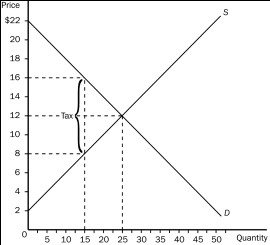

Figure 8-6

-Refer to Figure 8-6.As a result of the tax,

Definitions:

Capital Asset Pricing Model

A model that describes the relationship between systematic risk and expected return for assets, particularly stocks. It is widely used for pricing risky securities.

Market Rate

The prevailing interest rate available in the marketplace on investments, loans, and deposits.

Expected Rate

Expected Rate often refers to the return that investors anticipate earning on an investment over a certain period.

Risk-Free Rate

The theoretical return on investment with no risk of financial loss, often represented by the yield on government bonds.

Q26: For any country that allows free trade,<br>A)domestic

Q66: Refer to Figure 10-2.Assume the production of

Q139: Consider Figure 6-11.The amount of the tax

Q140: Which of the following events is consistent

Q142: Refer to Figure 9-1.If this country chooses

Q167: Refer to Figure 8-7.The government collects tax

Q169: Refer to Figure 9-14.With the tariff,the domestic

Q172: When the government imposes taxes on buyers

Q214: Refer to Figure 9-8.Consumer surplus in this

Q237: Suppose the Ivory Coast,a small country,imports wheat