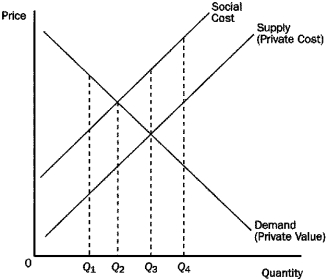

Figure 10-4

-Refer to Figure 10-4.Externalities in this market could be internalized if

Definitions:

150%-Declining-Balance

A method of accelerated depreciation, applying 150% of the straight-line rate to the declining balance of an asset, used to allocate larger depreciation expenses in the earlier years of an asset’s life.

Residual Value

The estimated value of an asset at the end of its useful life, often considered in leasing agreements and depreciation calculations.

Sum-Of-The-Years'-Digits Method

An accelerated depreciation method that computes annual depreciation by multiplying the depreciable cost of an asset by a series of fractions based on the sum of the asset's useful life digits.

Accumulated Depreciation

The total amount of depreciation expense that has been recorded for an asset since it was acquired, representing the reduction in value over time.

Q17: For most goods in an economy,the signal

Q49: Roads can be considered either public goods

Q55: If the world price of a good

Q60: Taxes cause deadweight losses because they prevent

Q111: When the social cost curve is above

Q118: An optimal tax on pollution would result

Q166: Import quotas and tariffs produce some common

Q213: Who among the following is a free

Q248: A market for pollution permits can efficiently

Q249: Market failure associated with the free-rider problem