Multiple Choice

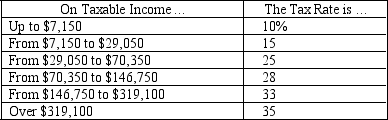

Table 12-1

-Refer to Table 12-1.If Chris has $100,000 in taxable income,his tax liability will be

Definitions:

Related Questions

Q49: Economists normally assume that the goal of

Q50: It is commonly argued that national defense

Q61: The difference between a corrective tax and

Q82: An advantage of a consumption tax over

Q110: Suppose that for a particular firm the

Q139: Implicit costs<br>A)do not require an outlay of

Q166: Lump-sum taxes are equitable but not efficient.

Q223: Which city currently charges drivers a "congestion

Q287: When a factory is operating in the

Q287: Which of the following countries has adopted