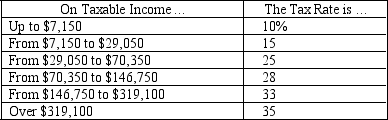

Table 12-1

-Refer to Table 12-1.If Morgan has $29,050 in taxable income,her tax liability will be

Definitions:

Bonuses

Additional financial compensation awarded to employees or individuals beyond their normal earnings.

Cost Centers

Departments or segments within an organization that do not directly generate revenue but incur costs, such as human resources or research and development.

Profits

The financial gain made in a transaction or business operation after accounting for all expenses.

Sales Training

A program or series of educational activities designed to enhance the skills and knowledge of sales personnel.

Q5: An example of an explicit cost of

Q38: Refer to Figure 13-7.Which of the figures

Q56: The marginal cost curve crosses the average

Q83: Which of the following is not a

Q92: The Tragedy of the Commons occurs because<br>A)government

Q128: When a firm is able to put

Q184: XYZ corporation produced 300 units of output

Q206: Excludability is the property of a good

Q250: At what level of output will average

Q291: Refer to Scenario 12-1.Assume that the government