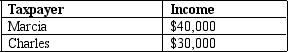

Table 12-8

-Refer to Table 12-8.If the government imposes a $2,000 lump-sum tax,the average tax rate for Marcia and Charles would be

Definitions:

Material Handling

The activities involved in moving, storing, controlling, and protecting materials and products throughout the manufacturing, distribution, consumption, and disposal processes.

Storage Costs

Storage costs are expenses associated with warehousing and holding inventory, including rent, utilities, and other maintenance expenses for storage facilities.

Activity-Based Costing

Activity-based costing is an accounting method that assigns costs to products or services based on the activities that go into producing them, thereby giving more accurate insights into the costs and profitability of each.

Facility Sustaining Costs

Expenses incurred to maintain the operational capacity of a physical facility or infrastructure, excluding costs related to direct production activities.

Q8: The government finances the budget deficit by<br>A)borrowing

Q42: If the average total cost curve is

Q64: The firm's efficient scale is the quantity

Q176: Sue earns income of $80,000 per year.Her

Q190: Refer to Table 12-6.What is the average

Q194: When fixed costs are ignored because they

Q196: If transfer payments are included when evaluating

Q201: If a tax system is designed so

Q204: The marginal tax rate for a lump-sum

Q233: Which of the following statements about a