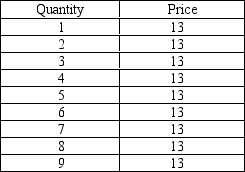

Table 14-1

-Refer to Table 14-1.Over which range of output is average revenue equal to price?

Definitions:

IFRS Deferred Tax Assets

Assets recognized in financial statements under International Financial Reporting Standards (IFRS) due to temporary differences that will result in deductible amounts in the future.

Interperiod Tax Allocation

The process of distributing income tax expenses or benefits over different accounting periods because of temporary differences that cause deferred tax amounts.

Intraperiod Tax Allocation

The allocation of income tax expense or benefit among various components of comprehensive income, net income, and other directly related statements within a single period.

Current Taxes Payable

This refers to the amount of taxes a company is obligated to pay to the government within the current fiscal year, not yet paid.

Q2: When the marginal tax rate exceeds the

Q18: A firm must be participating in a

Q73: A firm will shutdown in the short

Q140: Refer to Figure 13-1.With regard to cookie

Q143: Refer to Figure 13-9.The firm experiences economies

Q165: Lump-sum taxes are rarely used in the

Q199: Refer to Table 14-4.What is the marginal

Q235: Average variable cost is equal to total

Q247: Refer to Table 14-2.Consumers are willing to

Q254: Antitrust laws allow the government to<br>A)prevent mergers.<br>B)break