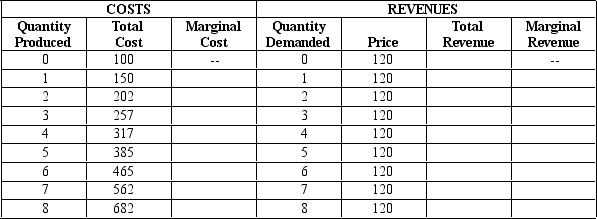

Table 14-2

The following table presents cost and revenue information for Soper's Port Vineyard.

-Refer to Table 14-2.Consumers are willing to pay $120 per unit of port wine.What is the marginal cost of the 1st unit?

Definitions:

Alimony Deduction

A tax deduction previously allowed for payments made under a divorce or separation agreement to a spouse or ex-spouse, phased out after the 2018 tax year for new agreements.

Divorce Decree

A legal document formalizing the terms of a divorce, including arrangements for alimony, child support, and division of property.

Mortgage Payments

Mortgage payments are regular payments made by a borrower to a lender, typically consisting of principal and interest, for the repayment of a mortgage loan used to purchase property.

Self-Employed Health Insurance

A deduction available for the premiums paid on a health insurance policy covering a taxpayer who is self-employed, their spouse, and dependents.

Q14: Refer to Table 13-7.One month,Teacher's Helper produced

Q32: Additional firms often do not try to

Q43: A lump-sum tax<br>A)is most frequently used to

Q44: Profit-maximizing firms enter a competitive market when,for

Q46: Refer to Figure 14-2.Which line segment best

Q131: The benefits principle is used to justify<br>A)property

Q220: Total cost can be divided into two

Q250: As a general rule,profit-maximizing producers in a

Q255: For a monopoly,the socially efficient level of

Q258: Refer to Table 13-7.What is the marginal