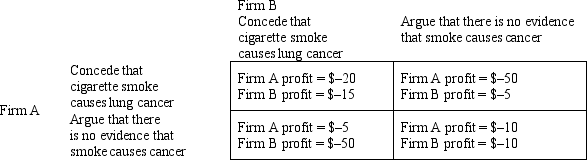

Table 16-8

Two cigarette manufacturers (Firm A and Firm B) are faced with lawsuits from states to recover the healthcare related expenses associated with cigarette smoking. Both cigarette firms have evidence that indicates that cigarette smoke causes lung cancer (and other related illnesses) . State prosecutors do not have access to the same data used by cigarette manufacturers and thus will have difficulty recovering full costs without the help of at least one cigarette firm study. Each firm has been presented with an opportunity to lower its liability in the suit if it cooperates with attorneys representing the states.

-Refer to Table 16-8.If both firms follow a dominant strategy,Firm B's profits (losses) will be

Definitions:

Deferred Taxes

Taxes that are due on income or transactions that have been recorded in the financial statements but have not yet been settled in cash.

Tax Contingency Reserve

A tax contingency reserve is an accounting provision made to cover potential tax liabilities that may arise due to uncertainties in the interpretation of tax laws or disputes with tax authorities.

Earnings Quality

An assessment of the true income generated by a company, gauging how accurately the reported income reflects the company's true earning power.

Deferred Tax Assets

Assets on a company's balance sheet that may be used to offset future tax liabilities.

Q15: When a firm's average total cost curve

Q39: One solution to the problems of marginal-cost

Q81: In an oligopoly,<br>A)the total output produced in

Q116: A natural monopoly arises when<br>A)there are constant

Q167: Refer to Figure 15-2.The marginal revenue curve

Q169: An oligopolist will increase production if the

Q173: A tit-for-tat strategy starts out<br>A)conciliatory and then

Q200: Price discrimination<br>A)forces monopolies to charge a lower

Q216: Refer to Table 17-3.Given the cost and

Q235: The administrative burden of regulating price in