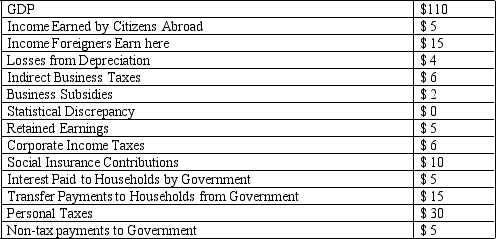

Table 23-1. The data pertain to the nation of Simplia for the year 2006.

-Refer to Table 23-1.Personal income for this economy is

Definitions:

FICA Taxes

FICA taxes are federal payroll taxes collected to fund Social Security and Medicare, divided into equal parts paid by employers and employees.

Student Loan Interest

The cost incurred from borrowing funds for education, which can often be deducted from taxable income under certain conditions in many tax jurisdictions.

Deduction Limit

The maximum amount that can be subtracted from taxable income for certain expenses, beyond which deductions are no longer permitted or are reduced.

Tax Year

The 12-month period for which tax is calculated, often either the calendar year or a fiscal year established by a business.

Q10: For monitoring fluctuations in the national economy,which

Q10: Refer to Table 22-1.If (1)the first vote

Q24: The equipment and structures available to produce

Q91: Which of these events would cause the

Q126: A consumer has preferences over two goods:

Q129: Which of the following statements is false?<br>A)Reducing

Q152: The classic example of moral hazard is

Q169: Let 2004 be the base year;then<br>A)Inflation rate

Q173: If the consumer price index was 100

Q200: In computing GDP,market prices are used to