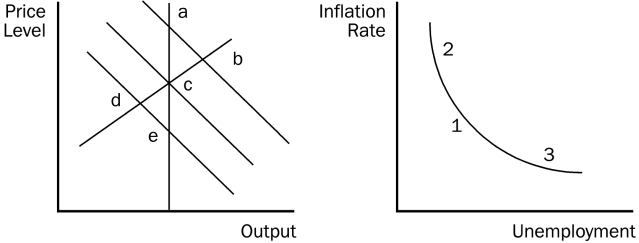

Use the pair of diagrams below to answer the following questions.

Figure 35-1

-Refer to Figure 35-1.If the economy starts at c and 1,then in the short run,an increase in government expenditures moves the economy to

Definitions:

Risk-free Rate

The theoretical return on investment with no risk of financial loss, often represented by the yield on government securities.

Exchange Rate

The price of one country's currency in terms of another, essential for currency exchange and international trade.

Inflation Rate

The speed at which the overall price level of goods and services increases, leading to a decrease in buying power.

Risk-free Rate

The expected return from an investment that carries no risk of losing money, commonly linked to government bonds.

Q2: In the long-run,all costs are<br>A)Fixed costs<br>B)Variable costs<br>C)Sunk

Q29: In liquidity preference theory,an increase in the

Q33: A business owner makes 50 items a

Q36: Ethanol Mandates<br>Congress has passed laws requiring that

Q80: Which of the following would not be

Q138: A permanent reduction in inflation would<br>A)permanently reduce

Q199: According to liquidity preference theory,if the quantity

Q238: For the United States,the most important reason

Q240: If the multiplier is 5,the MPC is<br>A)0.05.<br>B)0.5.<br>C)0.6.<br>D)0.8.

Q274: Stagflation would result from the aggregate supply