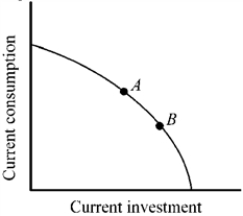

Figure 2-3

-Points A and B in Figure 2-3 indicate consumption and investment for two economies. Other things constant, which of the economies is likely to grow more rapidly in the future?

Definitions:

Basis Points

A unit of measure used in finance to describe the percentage change in the value or rate of a financial instrument, equal to 1/100th of 1%.

Duration

An indicator of how the price of a bond or other debt security responds to interest rate fluctuations, typically represented in years.

Market Yield

Market yield refers to the current rate of return anticipated on a bond if held to maturity, factoring in both its price and interest payouts compared to the market's interest rates.

Interest-Rate Sensitivity

The degree to which the price of an investment, often a bond, responds to changes in interest rates.

Q37: The opportunity cost of building a park

Q47: An increase in the price of a

Q87: Which of the following groups would most

Q114: Market economies are often criticized for how

Q122: If a decision maker uses marginal analysis,then

Q175: Which of the following would be most

Q198: The basic difference between macroeconomics and microeconomics

Q226: After the terrorist attacks on September 11,2001,the

Q359: Which one of the following would most

Q368: If price falls,what happens to the demand