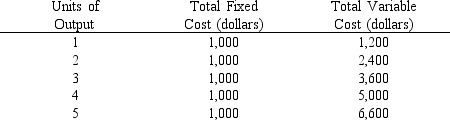

Use the table below to answer the following question.

What is the average total cost at an output level of four units?

Definitions:

Tax Rate

The tax rate is the percentage at which an individual or corporation is taxed, which can vary based on income level, type of income, or value of goods and services.

Inflation Rate

The rate of increase in prices across a broad spectrum of goods and services, resulting in reduced purchasing power.

Saving

The portion of income not spent on consumption but kept aside for future use, often in a deposit account or as an investment.

Classical Dichotomy

The conceptual distinction between real and nominal variables within the economy, implying that alterations in the money supply solely impact nominal variables.

Q49: An appreciation of a nation's currency means

Q52: Average fixed costs<br>A)will remain unchanged as output

Q53: A recent study on enrollment at a

Q63: A nation's trade deficit will tend to

Q77: If the exchange rate between the U.S.dollar

Q99: When the price elasticity of demand is

Q117: Under a system of flexible exchange rates,which

Q165: If a 30 percent decline in the

Q176: Along the inelastic portion of a demand

Q205: As new firms enter a competitive price-searcher