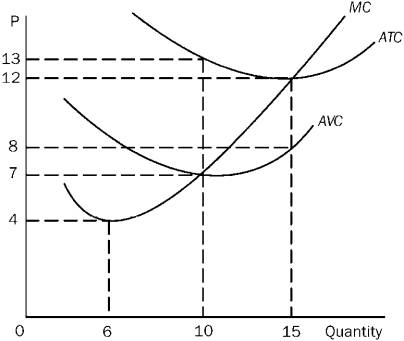

Figure 8-14

The following question(s) refer(s) to the below cost curves for one very small firm in a large market.

-Refer to Figure 8-14.If the firm produces 10 units of output,its total cost is

Definitions:

Risk-Return Dominance

A principle stating that an investment or portfolio is more desirable if it has a higher expected return for a given level of risk, or lower risk for a given level of expected return.

Market Equilibrium

Market Equilibrium is a condition in a market where the quantity demanded by consumers equals the quantity supplied by producers, resulting in stable prices.

Factor Risk

The risk associated with a specific factor or factors that can affect the performance of an investment portfolio, unrelated to broader market movements.

Risk Premium

The additional return expected by an investor for accepting a higher level of risk compared to a risk-free asset.

Q19: Why is it considered "ideal" for price

Q29: For a price-taker firm,marginal revenue is<br>A)equal to

Q80: As the period for firms to expand

Q101: According to Figure 8-4,at what output would

Q109: When the owner of a business invests

Q114: The price elasticity of demand for a

Q159: The three basic legal forms of business

Q179: Other things constant,if wheat production is a

Q196: The boss observes that her 10 workers

Q208: If the board of regents of a