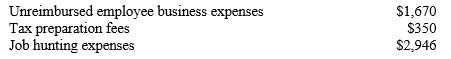

Marla and Victor Zapata have the following eligible miscellaneous itemized deductions:

They have an adjusted gross income of $63,000 and other itemized deductions of $8,580.How much of the above miscellaneous expenses can they add to their other itemized deductions?

Definitions:

Partitioning Technique

A method used in computing and mathematics to divide data sets or problems into smaller, more manageable parts.

Extended Definition

An explanation that goes beyond a simple dictionary definition by providing additional context, examples, and details.

Set of Instructions

comprises detailed, step-by-step information on how to complete a task or operate something.

Absolute Distinction

A clear and definite difference that sets two or more things apart without overlap.

Q6: Generally,consolidation loans may _ monthly payments, _ the

Q31: The outstanding balance owed on a debt

Q35: Perhaps the greatest disadvantage of credit use

Q63: On declining-balance installment loans,the APR is the

Q72: The value of an asset less the

Q100: A cash advance can be obtained by

Q102: The strictest method of controlling budgets is<br>A)justifying

Q122: Repossession is a legal proceeding by which

Q123: The Equal Credit Opportunity Act prohibits the

Q124: Advantages of credit use include increased protection