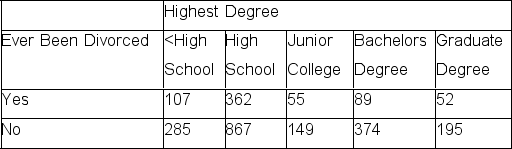

Calculate the marginals for the table below.

Definitions:

High-Income Taxpayers

Individuals who are in the upper brackets of the tax scale, typically subject to higher tax rates and additional taxes on investment income.

Itemized Deductions

Expenses that taxpayers can subtract from their gross income to reduce the taxable income, including payments like mortgage interest, state taxes, and charitable contributions, as specified by the IRS.

Forfeit

The loss of any right, privilege, or property because of a breach of obligation or failure to meet a requirement.

Mileage Reimbursement

Compensation for fuel and wear-and-tear expenses for the use of a personal vehicle for business purposes, usually calculated by the mile.

Q11: After calculating the between-group sum of squares

Q12: What is the interpretation for the slope

Q15: Construct a box plot based on the

Q26: Biofeedback training allows people to consciously control

Q32: What can you say about the relationship

Q35: A patient who demonstrates uncharacteristically poor judgment

Q42: The sampling distribution of chi-square sampling can

Q48: A research hypothesis (H₁)is said to be

Q74: A microtome is a <br>A)stain. <br>B)fixative. <br>C)machine used to slice

Q122: The study of microscopic structures and tissues