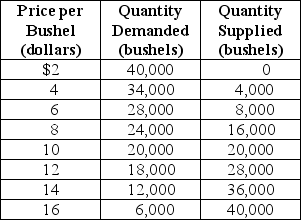

Table 4-4

Table 4-4 above contains information about the corn market. Answer the following questions based on this table.

-Refer to Table 4-4.An agricultural price floor is a price that the government guarantees farmers will receive for a particular crop.Suppose the federal government sets a price floor for corn at $12 per bushel.

a.What is the amount of shortage or surplus in the corn market as result of the price floor?

b.If the government agrees to purchase any surplus output at $12,how much will it cost the government?

c.If the government buys all of the farmers' output at the floor price,how many bushels of corn will it have to purchase and how much will it cost the government?

d.Suppose the government buys up all of the farmers' output at the floor price and then sells the output to consumers at whatever price it can get.Under this scheme,what is the price at which the government will be able to sell off all of the output it had purchased from farmers? What is the revenue received from the government's sale?

e.In this problem we have considered two government schemes: (1)a price floor is established and the government purchases any excess output and (2)the government buys all the farmers' output at the floor price and resells at whatever price it can get.Which scheme will taxpayers prefer?

f.Consider again the two schemes.Which scheme will the farmers prefer?

g.Consider again the two schemes.Which scheme will corn buyers prefer?

Definitions:

Joint Venture

A business arrangement in which two or more parties agree to pool their resources for the purpose of accomplishing a specific task, project, or business activity.

Fair Value

The monetary return from asset divestiture or the financial responsibility for liability transfer occurring in an organized marketplace exchange at the valuation juncture.

Book Value

Book Value is the value of an asset as recorded on the company's balance sheet, representing the asset's cost minus accumulated depreciation or amortization.

Deferred Tax Asset

An accounting term used to describe a situation where a company has paid more taxes to the government than it has shown as an expense in its financial statements, which can be used to reduce future tax liability.

Q2: One reason a country does not specialize

Q19: Quantity supplied refers to the amount of

Q23: Lucinda buys a new GPS system for

Q30: Why is it necessary for all economic

Q42: An increase in the demand for lobster

Q85: Refer to Table 3.1.The table above shows

Q90: In September 2006, the Canadian Food Inspection

Q114: If, for a given percentage increase in

Q116: Explain why economics is considered a social

Q135: Refer to Figure 3.5.In a free market