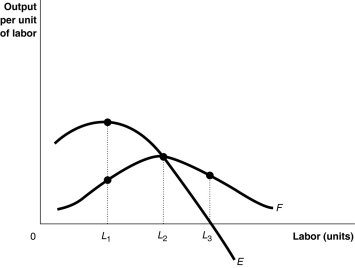

Figure 9.2

-Refer to Figure 9.2.The average product of labour declines after L₂ because

Definitions:

Ability-To-Pay Principle

A tax theory stating that taxes should be levied according to an individual or entity’s capacity to pay.

Benefits Principle

A theory in taxation stating that those who benefit from government services should pay taxes in proportion to the amount they benefit.

Government Services

Public programs and activities provided by the federal, state, and local governments to benefit their citizens.

Ability-To-Pay Principle

A taxation principle that suggests taxes should be levied according to an individual's or entity's capacity to pay, typically measured by income or wealth.

Q21: The price elasticity of demand for Stork

Q27: Price elasticity of supply is used to

Q29: After getting an A on your economics

Q42: Which of the following statements is true

Q61: Consumers have to make tradeoffs in deciding

Q68: An expansion path shows<br>A)the level of sales

Q69: In the short run, if price falls

Q78: The law of diminishing marginal returns<br>A)explains why

Q100: When there few close substitutes available for

Q128: Refer to Figure 10.5.The firm's manager suggests