Figure 13.2

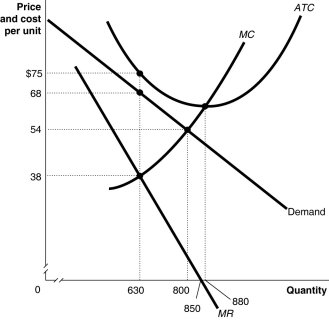

Figure 13.2 above shows the demand and cost curves facing a monopolist.

-Refer to Figure 13.2.Suppose the monopolist represented in the diagram above produces positive output.What is the profit/loss per unit?

Definitions:

Sharpe

A ratio used to calculate the risk-adjusted return of an investment, comparing the excess return of the investment to its standard deviation of returns.

Jensen Portfolio Performance Measures

A performance measurement method that evaluates the risk-adjusted return of an investment portfolio by comparing it to the expected return.

Investment Scenario

A projection or model of potential financial outcomes based on specified conditions or assumptions.

Dollar-Weighted

A method of calculating investment returns that accounts for the timing and amount of cash flows into and out of the investment.

Q10: Refer to Figure 10.3.Suppose the prevailing price

Q51: Refer to Table 15.1.Suppose a series of

Q74: Refer to Figure 13.6.The deadweight loss due

Q93: In perfect competition<br>A) the market demand curve

Q94: Suppose a competitive firm is paying a

Q98: In the long run, a perfectly competitive

Q104: Refer to Figure 13.2.Suppose the monopolist represented

Q107: If in a perfectly competitive industry, the

Q129: When you buy at a low price

Q135: Refer to Figure 10.6.Identify the firm's short-run