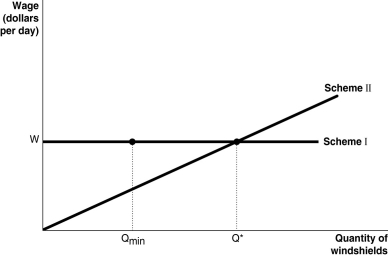

Figure 14.5

Figure 14.5 shows two different compensation schemes for the Safelite Glass Corporation, an installer of auto glass windshields. Under Scheme I, the firm pays a consistent wage of $160 per day based on an 8-hour workday. Qmᵢn represents the cut-off point under the hourly-wage system: if a worker installed fewer than Qmᵢn windshields, the worker got fired. Scheme II represents a piece-rate scheme with an earnings floor: no worker would get less than $160 per day (for an 8-hour workday) and would have to produce at least Qmᵢn. For any output level beyond Q* the worker earned an additional $20 for each unit produced.

-Refer to Figure 14.5.Which of the following statements about Scheme II is false?

Definitions:

Interest

The cost of borrowing money or the payment received for the investment of money, typically expressed as a percentage of the principal.

Maturity Value

Maturity Value is the amount payable to an investor at the maturity date of a financial instrument, typically including the principal and the interest.

Note Receivable

A written promise to pay a specified amount, usually interest-bearing, that is recognized as an asset on the lender's balance sheet.

Promissory Notes

Written promises to pay a specified sum of money to a certain person or entity at a defined time or on demand.

Q5: All of the kinds of living things

Q9: A firm that can effectively price discriminate

Q34: Refer to Table 13.2.What is the approximate

Q74: Refer to Figure 13.6.The deadweight loss due

Q74: If a firm has excess capacity, it

Q99: As a form of business, a partnership<br>A)has

Q108: If we use a narrow definition of

Q111: Each member of OPEC can increase its

Q135: The Buda Agri Corporation is the sole

Q140: Refer to Table 14.1.The marginal product of