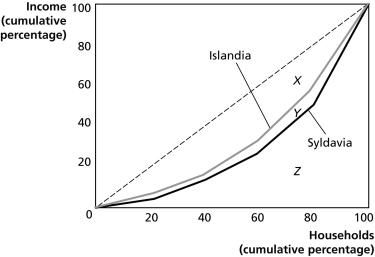

Figure 15.5

Figure 15.5 shows the Lorenz curves for Islandia and Syldavia.

-Refer to Figure 15.5.Which country has the more unequal distribution of income?

Definitions:

U.S. Tax Liability

The total amount of tax owed to the U.S. government, including federal, state, and local taxes, by an individual, corporation, or other entity in a given tax year.

Foreign Income Taxes

Taxes paid to a foreign government for income earned from sources within that foreign country, which may be subject to tax credit or deduction in the taxpayer's home country.

Education Credit Deduction

A tax benefit that reduces the amount of income tax owed by students or their families based on qualified education expenses, intended to decrease the cost of further education.

Qualified Expenses

Specific expenses that meet the criteria to be tax-deductible or eligible for tax credits.

Q44: The only type of business that faces

Q46: You notice that water is running off

Q74: What is the incentive for a firm

Q75: Prokaryotic cells lack:<br>A)DNA.<br>B)proteins.<br>C)internal compartmentalization.<br>D)ribosomes.

Q78: Competition from substitute goods is more of

Q93: Which of the following is a necessary

Q97: Which of the following will not cause

Q99: Which of the following describes two-part tariff

Q122: If a corporate bond with face value

Q149: Refer to Figure 14.4 to answer the