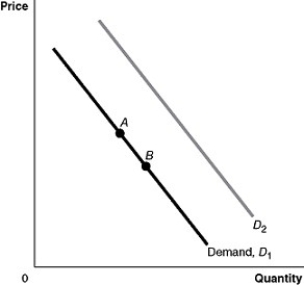

Figure 3-1

-Refer to Figure 3-1.An increase in taste or preference would be represented by a movement from

Definitions:

Black-Scholes Option

A mathematical model used to price European options and derivatives by estimating the variation over time of financial instruments.

Implied Volatility

The market's forecast of a likely movement in a security's price, often derived from the price of its options.

Binomial Option Model

A mathematical model used to price options by breaking down the option's life into discrete time intervals and calculating the value at each step.

Interest Rate

The percentage of a sum of money charged for its use, typically expressed as an annual percentage on a loan or investment.

Q6: Refer to Figure 2-6.If the economy is

Q93: Refer to Table 2-14.Does either Ireland or

Q94: The income effect of a price change

Q96: If the price of peaches,a substitute for

Q103: If additional units of a good could

Q261: Refer to Table 2-16.What is Estonia's opportunity

Q296: In July,market analysts predict that the price

Q419: Refer to Table 2-5.Assume Nadia's Neckware only

Q457: Refer to Figure 2-8.What is the opportunity

Q470: Refer to Table 2-11.China has a comparative