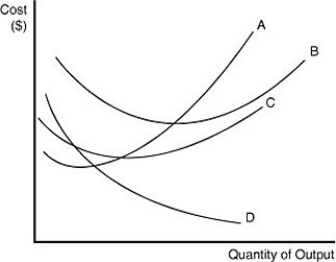

Figure 8-6

Figure 8-6 contains information about the short run cost structure of a firm.

Figure 8-6 contains information about the short run cost structure of a firm.

-Refer to Figure 8-6.In the figure above,which letter represents the average fixed cost curve?

Definitions:

Market Yield

The annual income return as a percentage of the market price of an investment.

Zero-Coupon Bond

A type of bond that does not pay interest during its life but is sold at a deep discount, providing profit at maturity when it is redeemed for its face value.

Matures

The point at which a financial instrument, such as a bond or loan, reaches its due date and the principal is to be paid back.

Yield-To-Maturity

The total return anticipated on a bond if the bond is held until its maturity date, considering all interest payments and the principal repayment.

Q32: Refer to Table 9-4.If the market price

Q59: Assume the market for organically-grown produce is

Q68: In the short run,why does a production

Q94: Refer to Figure 9-10.The total cost at

Q162: When the government wants to give an

Q164: A firm's total profit can be calculated

Q216: BHP Billiton is a Canadian company that

Q218: Which of the following arguments could be

Q251: A characteristic of the long run that

Q288: The iPod is a product without any