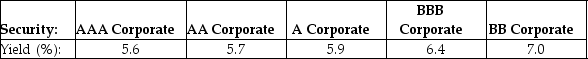

A mining company needs to raise $100 million in order to begin open pit mining of a coal seam.The company will fund this by issuing 30-year bonds with a face value of $1000 and a coupon rating of 6%,paid annually.The above table shows the yield to maturity for similar 30-year corporate bonds of different ratings.If the mining company's bonds receive a A rating,what will be their selling price?

Definitions:

Q11: Longbow Lumber is purchasing a new horizontal

Q48: What,typically,is used to calculate the opportunity cost

Q67: A bond is currently trading below par.Which

Q77: A bakery invests $30,000 in a light

Q84: A coupon bond with a face value

Q91: A firm has contracted to supply 500,000

Q94: Adelaide Industries expects to have earnings per

Q95: Individual investors who grow up and live

Q102: Conundrum Mining is expected to generate the

Q106: Bond traders generally quote bond yields rather