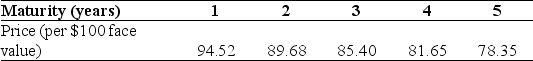

Use the table for the question(s) below.

The following table summarizes prices of various default-free zero-coupon bonds (expressed as a percentage of face value) :

-The yield to maturity for the two-year zero-coupon bond is closest to:

Definitions:

Compounded Monthly

A term used in finance to describe a process where interest is added to the principal balance of an investment or loan each month, and future interest accumulations are based on the new balance.

Interest

The cost of borrowing money or the return on investment, calculated as a percentage of the principal amount over a period.

Additive Inverse Property

The principle that for any number, there exists another number such that the sum of both is zero.

Real Numbers

All the numbers that can be found on the number line, including both positive and negative numbers, zero, and irrational numbers.

Q21: If the interest rate is 10%,then which

Q31: What is the need for the notes

Q37: When there are large numbers of people

Q40: In Canada over the long term,small stocks

Q45: A small business refits its store.The builders

Q60: A firm has $6 million in cash,$1.5

Q77: According to the text,did Enron follow Generally

Q80: Why is the yield of bonds with

Q84: CIBC has 110 million shares outstanding,with a

Q103: A manufacturer of breakfast cereals has the